Summary

- GlaxoSmithKline (GSK) has a diversified portfolio of products, strong pipeline and market leading positions in many geographies.

- The company’s sales and EPS have been in upward trend since 2016.

- Dividend yield of 6.26% is attractive and high for healthcare industry. Payout ratio has been improving significantly in recent years and stands at 69% at the end of 2020. However lower dividend is expected as of 2022.

- GSK will be restructured into two separate companies by 2022. More focused approach would allow each of those companies to benefit from growth in their respective markets. Its stock is 97% undervalued according to our valuation model.

Dividend

Dividend  Revenue

Revenue  Profitability

Profitability  Financial Strength

Financial Strength  Investment Case

Investment Case

British pharmaceutical company GlaxoSmithKline Plc (GSK) is present in 95 countries. It has three global businesses that discover, develop and manufacture innovative medicines, vaccines and consumer healthcare products:

- Pharmaceuticals – 50% of sales. Develops respiratory, HIV, immune – inflammation and oncology medicines with the focus on the science related to the immune system, human genetics and advanced technology.

- Vaccines – over 20% of sales. GSK is the largest vaccines company in the world by revenue.

- Consumer Healthcare – around 30% of sales. GSK has a wide range of market leading brands. In 2019 GSK and US pharma group Pfizer combined their two consumer healthcare businesses. GSK retained a control with 68% of ownership interest. After this merger the division has the largest market share globally.

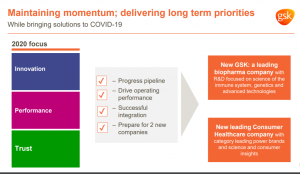

Before the change in leadership in 2017, the company had numerous legal penalties for unethical and illegal activities. The newly appointed management announced that its priorities are Building Innovation, Performance and Trust.

GSK has a wide list of patent protected drugs and as older products go off patent, it should invest in the pipeline of the next generation drugs. GSK is improving a pipeline by investing into it heavily. It invested in R&D GBP 4.6 B in 2019 and GBP 5.1 B in 2020.

GSK was one of those companies which had to rapidly mobilize and respond to the pandemic. The company has agreements with governments to supply over 1 B doses of adjuvant in 2021.

The company is active in M&A field. In recent years it bought US biotech Tesaro for USD 5.1 B and sold consumer nutrition business to Unilever for EUR 3.3 B. At the beginning of 2020 GSK started separation into two companies: new GSK, biopharma company and a new Consumer Healthcare company. The process should be finalized in 2022.

Dividend

Dividend

The company’s policy is to pay quarterly dividend from free cash flow available after the investment necessary for future growth. GSK pays flat annual dividend of GBP 0.8 for 8 years in a row. It intends to keep it the same for 2021. However as a result of separation of GSK into two companies, lower dividend is expected as of 2022. Also the company mentioned that it would return to the progressively increasing dividend. It is unclear by how much dividend will be lower. A new distribution policy will be revealed on investor update event in June. Fourth quarter’s dividend’s ex-dividend date is February 18.

The company has had historically high payout ratio. But in recent years it has been down substantially. At present it is reasonable at 69%, particularly in comparison with the 5 years average of 184%. Free cash flow (as defined by the company) was GBP 5.4 B last year. The cost of dividend was GBP 3.98 B. So dividend is well covered by both earnings and free cash flow.

Dividend yield of 6.26% is the highest amongst peers. Even if dividend will be lower in the future, it should be at good enough level for long term investors, particularly in combination with possible upside in stock price, mentioned below.

Revenue

Revenue

Over the last 5 years sales have increased over 7% annually in a consistent way. In 2020 sales are GBP 34.1 B, up 3% in constant exchange rate (CER) terms. COVID – 19 immunization program caused disruption to adult vaccinations. However the strong performance of HIV, Oncology and Consumer Healthcare more than compensated for it. Sales by divisions has been as follows for the year:

- Pharmaceuticals down 1%;

- Vaccines down 1%;

- Consumer Healthcare up 14% – mainly driven by inclusion of Pfizer portfolio.

New Biopharma product portfolio had 9 new approvals in 2020. Biopharma pipeline has over 20 assets in late – stage trials to be launched by 2026. More than 10 of them have potential to generate more than GBP 1 B in annual revenue. It should provide stability and growth to the company’s top line. Overall the company has 57 products (17 vaccines and 40 medicines) in a pipeline. Strong product portfolio and pipelines will drive revenue in both Pharma and Vaccines divisions. Consumer Healthcare division will continue capitalizing on its strong brands.

In 2021 the company expects revenue growth in every division:

- Pharmaceuticals – flat to low – single digit growth;

- Vaccines – also flat to low – single digits. Further disruption in the first half of the year is expected as governments will prioritize COVID – 19 vaccination. Second half of the year should bring strong recovery.

- Consumer Healthcare – low to mid – single digits.

Profitability

Profitability

For 2020 total operating profit is GBP 7.783 B, up 15% at CER. Adjusted operating profit is up 2% while sales increased 3%. Profit was impacted by the reduction in sales of the range of different vaccines of GSK due to the pandemic, price pressure, particularly in Respiratory, and investments in promotional product support. It is notable that GSK managed to grow operating profit in that extraordinary year.

The company’s EPS increased impressive six-fold from GBP 0.19 in 2016 to GBP 1.155 per share in 2020. Last year’s EPS is up 26% at CER compared to 2019. However adjusted EPS is down 4% as the increase is mostly attributable to the one – offs like sales of assets and Consumer Healthcare brands.

According to the company’s guidance adjusted EPS is expected to be lower by high-single digit percentage in 2021. However as soon as the impact of COVID subdues, the strong growth in Vaccines performance is expected. Significantly improved Biopharma pipeline and effective cost control should lead to the improved performance after 2021. In 2022 the management expects meaningful improvement in revenues and margins.

Financial Strength

Financial Strength

GSK’s total debt is GBP 27.15 B and equity GBP 20.808. So Debt -to- Equity ratio is very high at 130%. On the positive side it should be said that this ratio is much lower than in the past, it is in downward trend since 2016. In 2018 it was 687% and in 2019 256%. Net debt at the end of the year is GBP 20.78 B, lower by GBP 4.4 than last year due to the proceeds from the disposal of Horlicks and other brands.

Operating profit, GBP 7.78 B, is 29% of the total debt. The net cash from operations coverage is good as it is 31% of the total debt. Interest payments are also well covered by operating profit with coverage over 9x. So, the debt, despite being high, is not causing concerns at present.

Investment case

Investment case

In the past GSK significantly underperformed other big pharma companies. However it is regaining investors trust in recent years.

Now we estimate the future share price using historical average P/E ratio. The following assumptions are made to project the stock price.

- Underlying earnings are to decline next year but the management expects improvement in 2022. So we assume that EPS over 5 years is flat, i.e. EPS will be GBP 1.155.

- Dividend is GBP 0.80 per annum. We assume that it remains the same in the coming years. We assume that the forthcoming dividend cut is balanced by the possible future dividend increases. So over the next 5 years the total dividend income would be GBP 4 per share. By now we do not know by how much dividend would be cut as of 2022 and what kind of dividend increases could be expected thereafter. If a cut is substantial, our assumption could be overly optimistic.

- Future buy backs are not considered.

Multiplying EPS (GBP 1.155) by the average P/E over the last 5 years (21.75), gives us the rough indication what could be the stock price in 5 years period:

GBP 1.155 x 21.75 = GBP 25.12

That means GSK’s stock price upside potential is 97% from the current price GBP 12.77 if our assumptions come true.

Taking into account the expected dividend income over the next 5 years (GBP 4), the overall return on investment, if the stock is bought today, with dividends not reinvested, could be around 128% over the 5 years period or almost 18% compound return each year on average. That seems to be generous reward indeed.

There are many uncertainties related to the performance in the short term: the pandemic is not over yet, company restructuring is not finalized, global economy is still struggling. However GSK is a quality company with business diversified across medicines, vaccines and consumer healthcare products. After separation it will become a biopharma company with strong drug pipeline supported by large investments in R&D.

Notes

Data source – the company’s financial reports and its website. Source of pictures – the company website unless otherwise stated. Colored circles next to headings mean an author’s evaluation of the relevant performance criteria of the company: green means positive, yellow neutral and red negative evaluation. There are many ways to estimate the future stock price. We use only one of them, the one based on P/E ratio. All estimates made in the article are for the informational purposes only. They are the result of the rule of thumb assumptions and the real outcome might differ materially from those estimates. As the future unfolds, macro events, not mentioned in the article, could impact the company fundamentals. Use the information in the article as a starting point for your own due diligence.